National Digital ID : NDID

NDID : Digital Identity for zDOX

NDID is National Digital ID Company Limited. It was established under the cooperation, support and acceleration among all related parties both public sector and business sector for building trusted digital identity and data sharing platform called “NDID Platform or NDID”. NDID aims to be the country’s infrastructural digitization that can help building new creative services and businesses in the digital economy.

Identify and Verification

To be an important digital infrastructure system designed under the decentralized concept based on the blockchain technology, that will help make electronic transactions more effective, reliable and achieve international standards

Promote Online Self Service

To provide services in real time through online channels; elevate their service to customers through various channels; makes their service more efficient; and reduces management costs

Data Sharing

To support data exchange between relevant organizations, like a main superhighway that systematically connects all parties without the repetition of complex authentication and in which customers, as owners of the information, must provide consent before any further action

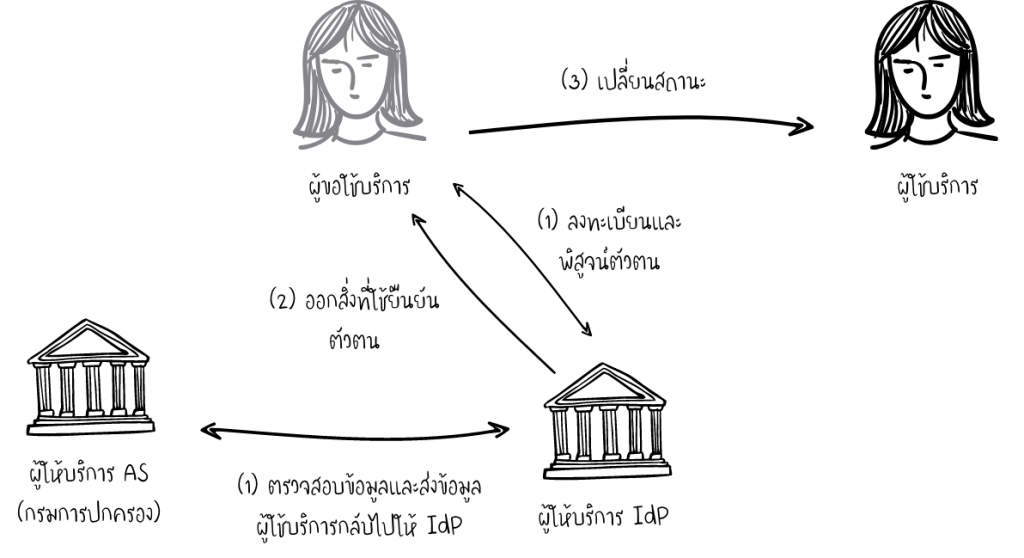

NDID Enrolment and Identity Proofing

The Applicant registers with an Identity Provider (IDP). Currently, 9 banks provide the service. The procedure for applying for the service is as follows:

General procedure

- The applicant opens an account at the Bank. The Bank will verify the identity of the Applicant following the Identity Assurance Level (IAL) strictness specified by the Bank according to the type of transaction requested.

- If the authentication is successful, the bank (IdP) will save your identities, such as the information in your ID card with verification against the Department of Provincial Administration’s database (Authoritative source: AS) and photograph of the applicant’s face to store as evidence in the bank’s database including something used to authenticate an identity such as a code or PIN;

- The applicant has changed the status to be a bank user. The bank will maintain the identity verification and the information that the applicant uses for registration throughout the life of the identified reference.

However, the identity verification of the applicant includes verification of identification evidence, verification of the connection between the applicant and the proof of identity, and verifying the information of the applicant with a reliable information provider (Authoritative Source: AS)

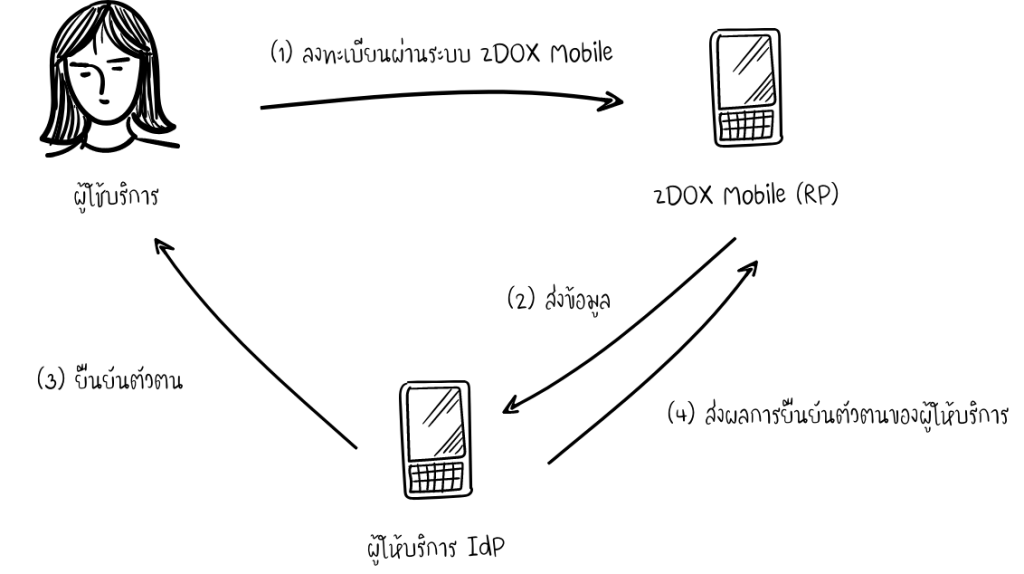

NDID Authentication

Users who want to use the zDOX which is a service provider that allows authentication via NDID (Relying Party: RP) for their credibility when they use e-Signature in the document.

General procedure

- The user registers at the zDOX system (RP) using a digital ID with the level of authentication specified by the zDOX system (Identity Assurance Level: IAL = 2.3) and the level of reliability of the identified item (Authenticator Assurance Level: AAL = 2.2). This level indicates the credibility that the authenticator is the same person who is registered with the bank (IdP).

- Once the user has accepted the registration and has selected the IDP provider they want to verify their identity. The information will be sent to the system of the IdP provider that the user chose to notify the user to perform identity verification.

- The user performs identity verification following the rules specified by the IdP service provider.

- After the IdP provider has verified the authenticity and status of the authentication. The system will send the confirmation of identity and other information to the zDOX system then the user can proceed to verify the personal information and the registration process will be completed.